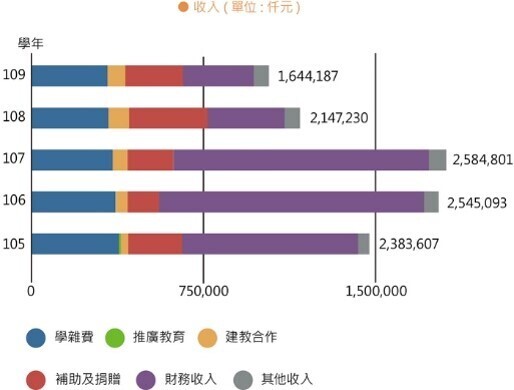

Financial Performance

The main aim of the financial planning of Ming Chi University of Technology (MCUT) is to cooperate with its medium- and long-term development plans. MCUT attempts to promote the implementation of various development plans, and evaluate implementation performance based on the ratio of planning to execution as well as the ratio of fund use. In order to rationalize budget allocation, MCUT takes concrete assessment of the allocated proportions of various types of revenue and expenditure funds, as well as budget implementation results, as the basis for the overall budget allocation. After the annual budget for an academic year is prepared and submitted to the school affairs meeting for deliberation, it will be submitted to the Board of Directors for deliberation. Such deliberation results will be taken as the basis for implementation in the academic year. The accounting affairs of MCUT are handled in accordance with consistent regulations for the accounting system of private schools. Accountants are hired to check the finance and tax compliance audit. The audit reports are posted on the Finance Zone onthe homepage of MCUT’s website, on which all financial information is disclosed and transparent. In addition, MCUT makes full use of its funds, and comply with the Guidelines for Investment and Use of Surplus of Private Schools. Apart from properly depositing the surplus in financial institutions, MCUT accepts recommendations of investment after professional assessments, and buys stocks of listed and OTC companies to increase financial income. As a result, MCUT has a sound financial system, and has no debts. Over the years, the Board of Directors has donated huge amounts of money, and established different funds for school affairs, special purposes and investments. Up to now, the accumulated balance is sufficient, and this is beneficial to the future development of MCUT. In accordance with the provisions of Article 53 of the Private School Law, “School legal persons and their schools shall finish preparing reports comparing budget and actual revenues and expenditures in four months after the end of the fiscal year, have them certified by legal person authority-approved CPAs along with the financial statements, and submit them to the legal person authority and school authority, respectively, for reference”. MCUT shall handle the aforesaid accordingly.